Mexico Energy Intelligence™ Releases Its 2024 Report Catalog Amid Regulatory Upheaval

A year of regulatory malpractice, legal controversy, and strategic uncertainty in Mexico’s energy landscape

Should investors Air Liquide, Talos, Pan American, or Harbour eventually seek international arbitration to resolve disputes, our reports will be indispensable”

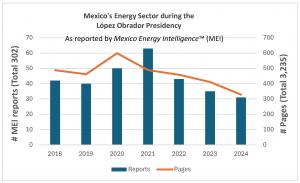

HOUSTON, TX, UNITED STATES, August 14, 2025 /EINPresswire.com/ -- The energy consultancy that is the publisher of Mexico Energy Intelligence™ (MEI) has issued its 2024 Annual Catalog, offering a comprehensive index of the year’s reports. The catalog presents annotated report titles in two formats: first, in ascending chronological order; and second, grouped by topic. Table 1 lists events in chronological sequence, sorted by topic. In 2024, MEI published 31 reports totaling 328 pages.— George Baker

The catalog is appended to MEI Report 994, which highlights moments and key developments in Mexico’s energy sector during 2024. Notable events include the premature death of Jesús Reyes Heroles G.G., a former energy minister and director-general of Petróleos Mexicanos (Pemex); the legally questionable seizure ordered by the government of the hydrogen plant in Pemex's Tula refinery owned by France's Air Liquide since 2017; the impasse in the development of the near-giant Zama reservoir, and, at yearend, on December 20, the constitutional amendment to Article 134, which, by merging the two energy regulators (CRE and CNH) into the energy ministry, conflated the distinct functions of regulation and policymaking.

The 2024 catalog covers the final year of the controversial presidency of Andrés Manuel López Obrador (2018-24), over the course of which MEI published 302 reports spanning 3,235 pages. (See graph nearby.) Under his leadership, there was a pivoting away from a market design in which the two state energy companies would compete with private investors for market share. Two examples illustrate his reversal of policy orientation: By the end of his term, by law, the state-owned electric utility (CFE) would generate 54% of the electricity dispatched to the national grid; renewable power generators would be relegated to the back of the dispatch queue. On the oil side, 50.4% of the ownership of the largest discovery in a generation (named Zama), which in 2017 had been made by private oil companies, in 2022 was assigned to Pemex.

"Our reports on institutions, laws, policies, and companies in Mexico's energy sector constitute a unique resource for investors, researchers, journalists, and policymakers," says publisher George Baker. "Should investors Air Liquide, Talos, Pan American, or Harbour (among others) eventually seek international arbitration to resolve disputes, our reports will be indispensable."

Since 1995, the consultancy has issued reports on the investment, institutional, and policy environments in Mexico and the Gulf of Mexico on both sides the U.S.-Mexico maritime boundary. MEI has consistently flagged offshore safety concerns. "The oil spill of 1979-80 at Pemex's Ixtoc-1 well flowed for eight months, taring the beaches of Corpus Christi," Baker recalls. He adds, "today, Pemex does not report on its offshore safety record or safety and environmental management system. This lack of transparency poses risks for coastal economies--yet public authorities, NGOs, investors, and journalists and industry associations remain incurious."

For stakeholders navigating Mexico’s evolving energy landscape, MEI’s 2024 catalog offers documentation, context, and insight.

George Baker

Mexico Energy Intelligence

+1 832-434-3928

g.baker@energia-mx.com

Visit us on social media:

LinkedIn

Facebook

X

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.