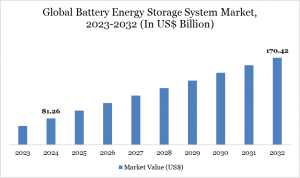

Battery Energy Storage System Market Set to Grow USD 170.42 Billion by 2032, Led by North America's 47.8% Market Share

The Battery Energy Storage System Market surges with renewable integration and grid stability demands. Innovations in lithium-ion drive are scalable for peak shaving and microgrids worldwide.”

AUSTIN, TX, UNITED STATES, December 19, 2025 /EINPresswire.com/ -- The Global Battery Energy Storage System Market reached USD 81.26 billion in 2024 and is expected to reach USD 170.42 billion by 2032, growing at a strong CAGR of 9.70% during the forecast period 2025–2032.— DataM Intelligence

Market growth is driven by the rapid expansion of renewable energy integration, increasing demand for grid stability and peak load management, and rising investments in utility-scale and distributed energy storage projects. Additionally, supportive government policies, declining battery costs, advancements in lithium-ion and next-generation battery technologies, and the growing adoption of electric vehicles and smart grids are further accelerating market adoption.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/battery-energy-storage-systems-market

United States: Key Industry Developments

-December 2025: Ford launched a dedicated Battery Energy Storage System (BESS) unit, targeting the data center sector as a primary offtaker by repurposing electric vehicle batteries for grid support and energy reliability.

-October 2025: Developers accelerated large-scale BESS projects amid a transitioning energy market, with operators adopting agile strategies to maintain profitability as revenues face pressures from policy shifts.

-September 2025: Major upcoming BESS projects like Darden, Bellefield, and Swiftsure advanced, with Bellefield's Phase 1 (500 MW solar + 500 MW/2,000 MWh storage) set for online status and a 15-year PPA secured.

Asia Pacific / Japan: Key Industry Developments

-December 2025: A 2 MW grid-scale BESS project in the Tokyo area officially started operations on December 9 after construction began in May, enhancing grid stability in a high-demand energy market.

-November 2025: Sonnedix Japan announced construction of its first 125 MWh BESS project in Oita prefecture, expanding hybrid renewables and battery storage solutions amid growing regional demand.

-August 2025: Banpu NEXT expanded its utility-scale BESS portfolio in Japan, targeting over 1 GWh capacity by 2030 with projects like Tono reaching commercial operation and government subsidies.

Key Merges and Acquisitions:

-Lyten – acquired Northvolt’s Dwa ESS operations in Gdansk, Poland, Europe’s largest BESS manufacturing facility at 25,000 sqm, enhancing its lithium-sulfur battery production and R&D capabilities for grid-scale storage.

-Energy Vault – expanded in the US ERCOT market by acquiring a 150MW BESS project in Texas, advancing deployment of advanced energy storage solutions amid rising renewable integration demands.

-Scania – purchased the industrial subset of Northvolt Systems in April 2025, securing key BESS manufacturing assets to support commercial vehicle electrification and energy storage initiatives.

Market Segmentation Analysis:

-By Battery Type: Lithium-ion Leads with 62% Share

Lithium-ion batteries command 62.10% market share in 2024, favored for high energy density, long lifespan, and fast charge-discharge cycles ideal for grid-scale and commercial use.

Lead-acid batteries hold a smaller share around 13%, used in cost-sensitive off-grid applications despite lower efficiency.

Flow batteries capture about 9%, excelling in long-duration storage for renewables; sodium-sulfur (NaS) batteries take roughly 6% for high-temperature industrial setups; others (e.g., nickel-based) fill the rest at under 10%.

-By Connection Type: On-grid Dominates at 74%

On-grid systems lead with 74.20% share, enabling peak load management, grid stability, and renewable integration.

Off-grid systems account for the remaining 25.80%, supporting remote or microgrid applications in areas without reliable power.

-By Energy Capacity: Above 5 MWh Implied Leader (Adapted from Related Data)

Below 500 kWh suits residential micro-storage at 20%; 500 kWh to 1 MWh targets small commercial at 18%; 3 MWh serves mid-scale industrial at 25%; above 5 MWh (aligning with greater than 500 MWh's 37% in broader data) dominates utility projects for large-scale renewables.

-By Application: Non-Residential (Utility/C&I) Tops at 52%

Non-residential, led by utility at 52.10%, drives grid balancing and renewable smoothing for large-scale deployments.

Residential holds 18%, growing via home solar backups; non-residential's commercial/industrial subset adds 23% for peak shaving.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=battery-energy-storage-systems-market

Growth Drivers:

-Accelerating integration of renewable energy sources like solar and wind, which require storage to manage intermittency and ensure steady supply.

-Rising demand for grid modernization and stability, enabling frequency regulation, peak shaving, and uninterrupted power during disruptions.

-Declining costs of lithium-ion batteries and advancements in alternative chemistries, making BESS more economically viable for large-scale deployment.

-Supportive government policies, incentives, and investments promoting decarbonization, energy independence, and low-carbon economies.

-Expanding applications in residential, commercial, and utility sectors, driven by increasing electricity demand and energy management needs.

Regional Insights:

-North America leads the Battery Energy Storage System (BESS) market with the highest regional share of approximately 47.8% in 2024, driven by robust policy support like the Inflation Reduction Act, surging demand for grid modernization, and significant deployments in the US for renewable integration.

-Asia Pacific follows as the second-largest region, capturing a substantial portion fueled by China's dominance in manufacturing (over 70% of global capacity), rapid solar and wind expansions in India and Australia, and government targets for 200+ GW of storage by 2030.

-Europe ranks third with around 24% market share, propelled by EU renewable directives, Germany's Energiewende initiatives, and growing utility-scale projects amid energy security concerns post-2022 crisis.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/battery-energy-storage-systems-market

Key Players:

Tesla, Inc. | LG Energy Solution | Samsung SDI Co., Ltd. | Panasonic Holdings Corporation | BYD Company Limited | Contemporary Amperex Technology Co. Limited (CATL) | ABB Ltd | Hitachi Energy Ltd | Siemens Energy AG | General Electric (GE) | Others

Key Highlights (Top 5 Key Players) for Battery Energy Storage System Market:

-Tesla, Inc. deployed record energy storage volumes exceeding 10 GWh in 2025, generating over USD 2.5 billion in energy segment revenue from Megapack and Powerwall systems.

-LG Energy Solution secured major grid-scale contracts, contributing approximately USD 1.8 billion to BESS revenues through international joint ventures and utility projects.

-Samsung SDI Co., Ltd. expanded its stationary storage portfolio, reporting around USD 1.2 billion in energy storage sales amid diversified applications in mobility and grid.

-Panasonic Holdings Corporation advanced renewable integration solutions, achieving USD 900 million in BESS-related revenues via partnerships in utility-scale deployments.

-CATL (Contemporary Amperex Technology Co. Limited) dominated Asia Pacific with vertically integrated production, driving USD 3.5 billion in global BESS market share leadership.

Conclusion:

The Battery Energy Storage System Market is poised for transformative growth, enabling seamless renewable energy integration and grid resilience amid rising electrification demands. Strategic investments in next-gen technologies like solid-state and flow batteries will unlock cost efficiencies and scalability. Ultimately, BESS will redefine global energy infrastructure, powering a sustainable, decentralized future.

Related Reports:

1. Thin-Film Batteries Market - expected to reach US$1,046.82 million by 2031, growing with a CAGR of 23.79% during the forecast period 2024-2031.

2. Industrial Batteries Market - expected to reach USD 2.35 billion by 2030.

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.